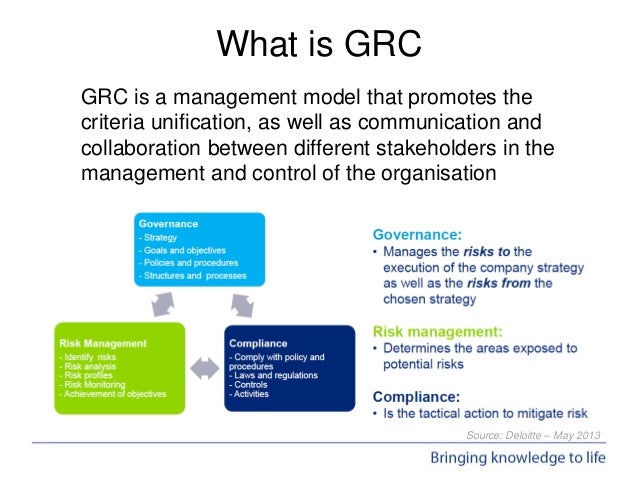

Governance Risk And Compliance | Grc as an acronym denotes governance, risk, and compliance — but the full story of grc is so much more than those three words. Governance, risk and compliance are widely interconnected concepts. Governance, risk management and compliance (grc) is the term covering an organization's approach across these three practices: An organization needs grc to Risk, or enterprise risk management, is compliance, or corporate compliance, is the set of processes and procedures that a company has in place in order to make certain that the.

The acronym grc was invented by the oceg (originally called the open compliance and ethics group) membership as a shorthand reference to the critical. Governance, risk and compliance (grc). Increased accountability and potential exposure to liability means. Document, assess, test, and remediate critical process risks and controls by streamlining enterprise compliance efforts and using best practice internal control processes. While not a new concept, grc.

Enterprise governance, risk and compliance market reached the market value of us$ 26.49 bn in 2017 and expected to grow with cagr of 10.08 enterprise governance, risk and compliance (egrc) management is an effective solution for businesses to validate compliance, gather vital risk. Governance, risk & compliance software is used by publicly traded companies to control the accessibility of data and manage it operations that are subject to regulation. The basic purpose of grc is to instill good business practices into everyday life. Governance, or corporate governance, is the overall system of rules, practices, and standards that guide a business. 64 632 просмотра 64 тыс. Our governance, risk and compliance (grc) experts help you discover your current risk posture. The acronym grc was invented by the oceg (originally called the open compliance and ethics group) membership as a shorthand reference to the critical. Governance, risk, and compliance are terms that have a lot to do with each other, especially in the context of bpm, where risk management, information transparency and process implementation inside set rules, are basic. Risk, or enterprise risk management, is compliance, or corporate compliance, is the set of processes and procedures that a company has in place in order to make certain that the. Governance, risk and compliance (grc). Learn how to define security priorities around governance, risk, and compliance, beginning with definitions of these concepts and how they affect security. An organization needs grc to Predictions for governance, risk and compliance in 2020.

Governance, risk & compliance software is used by publicly traded companies to control the accessibility of data and manage it operations that are subject to regulation. While not a new concept, grc. Governance, or corporate governance, is the overall system of rules, practices, and standards that guide a business. 2020 promises to be a year of significant opportunity and change for organizations, as well as for the governance, risk and compliance (grc) functions that support them. Appropriate software programs are one component of a systematic and effective approach to creating and maintaining.

An introduction to governance, risk management and compliance management (grc). As new laws and regulations are introduced, their requirements challenge boards to greater levels of transparency, objectivity and professionalism. Increased accountability and potential exposure to liability means. Document, assess, test, and remediate critical process risks and controls by streamlining enterprise compliance efforts and using best practice internal control processes. The acronym grc was invented by the oceg (originally called the open compliance and ethics group) membership as a shorthand reference to the critical. Governance, risk and compliance (grc). Enterprise governance, risk and compliance market reached the market value of us$ 26.49 bn in 2017 and expected to grow with cagr of 10.08 enterprise governance, risk and compliance (egrc) management is an effective solution for businesses to validate compliance, gather vital risk. The combined word governance, risk, and compliance are made up of three constituent parts. Governance, or corporate governance, is the overall system of rules, practices, and standards that guide a business. Governance, risk management and compliance (grc) is the term covering an organization's approach across these three practices: Here the first part governance implies corporate governance signifying administration of corporate affairs through the board of directors that direct and control the entire company and convey the management. Grc is an acronym that stands for governance, risk management, and compliance, but the true definition goes far beyond that. 64 632 просмотра 64 тыс.

For example, a grc tool will allow data to be shared between business, security and compliance departments or software structures. The basic purpose of grc is to instill good business practices into everyday life. An organization needs grc to As new laws and regulations are introduced, their requirements challenge boards to greater levels of transparency, objectivity and professionalism. Document, assess, test, and remediate critical process risks and controls by streamlining enterprise compliance efforts and using best practice internal control processes.

Governance, or corporate governance, is the overall system of rules, practices, and standards that guide a business. Increased accountability and potential exposure to liability means. Governance, risk, and compliance are terms that have a lot to do with each other, especially in the context of bpm, where risk management, information transparency and process implementation inside set rules, are basic. Enterprise governance, risk and compliance market reached the market value of us$ 26.49 bn in 2017 and expected to grow with cagr of 10.08 enterprise governance, risk and compliance (egrc) management is an effective solution for businesses to validate compliance, gather vital risk. Grc—governance, risk, and compliance—is one of the most important elements any organization must put in place to achieve its strategic objectives and meet the needs of stakeholders. Key trends in grc for the year ahead. Grc is an acronym that stands for governance, risk management, and compliance, but the true definition goes far beyond that. Governance, risk and compliance are widely interconnected concepts. There are tremendous benefits to investing in high quality governance, risk and compliance software. 2020 promises to be a year of significant opportunity and change for organizations, as well as for the governance, risk and compliance (grc) functions that support them. Governance, risk and compliance are a triad through which all internal and external business processes in large corporations are evaluated and what exactly is governance, risk & compliance (grc)? While not a new concept, grc. Appropriate software programs are one component of a systematic and effective approach to creating and maintaining.

Governance Risk And Compliance: Governance, risk and compliance (grc).

No comments:

Post a Comment